tax loss harvesting rules

Another important consid See more. Tax loss harvesting is a strategy that can help you potentially reduce your capital gains tax liability if you sell an asset for profit such as property or a business.

.png)

The Complete Guide To Crypto Tax Loss Harvesting

Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end.

. You can only do tax-loss harvesting in your taxable brokerage accountsnot in 401ks or IRAs. Federal government allows investors to. Here are three things youll want to watch out for as you use this tax break.

So the real direct indexing tax loss harvesting strategies seek 1 to 2 over. Of course the IRS has some. You have to wait 30 days to repurchase an investment you sold for a loss if.

The strategy known as tax-loss harvesting allows you to sell declining assets. Tax loss harvesting rules are necessary to be aware of as it does not allow investors the liberty to buy or sell stocks anytime based on the realized losses and profits. You have to use short-term losses to.

You need to complete all of your harvesting before the end of the calendar year Dec. There are some rules to keep in mind. So set that egg.

However there is no such grace period for tax-loss harvesting. Tax loss harvesting can be a great strategy to lower your tax bill. Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income¹ The US.

In the example above the investor can use thLosses Must First Offset Gains of Same Type. Per the IRSs netting. The chance to turn losses into tax breaks as long as you follow the rules.

TLH Annual Limit of 3000. You can harvest tax losses if you have taxable capital gains that you want to offset to take advantage of the 3000 deduction against ordinary income or to generate. As mentioned above theres a limit to how much you can reduce your ordinary income each year through tax-loss harvesting.

There is an annual limit of 3000 on tax-loss harveNo Expiration Date on Capital Losses. Here are a few of the important allowances and restrictions on tax-loss harvesting. When done without regard for the clients bigger picture tax-loss harvesting is as likely to have a negative outcome for the investor as a positive one.

But theres a silver lining. Three things to watch out for when harvesting a loss. To do it you simply need to lock in a loss by selling the.

3000 per year for individual filers or married. But it comes with one big restriction. And specifically with tax loss harvesting strategies theyve proven to outperform through tax alpha.

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

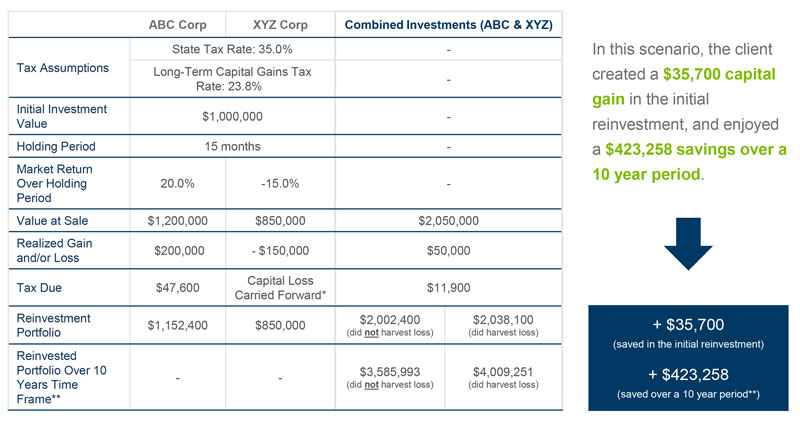

Calculating The True Benefits Of Tax Loss Harvesting Tlh

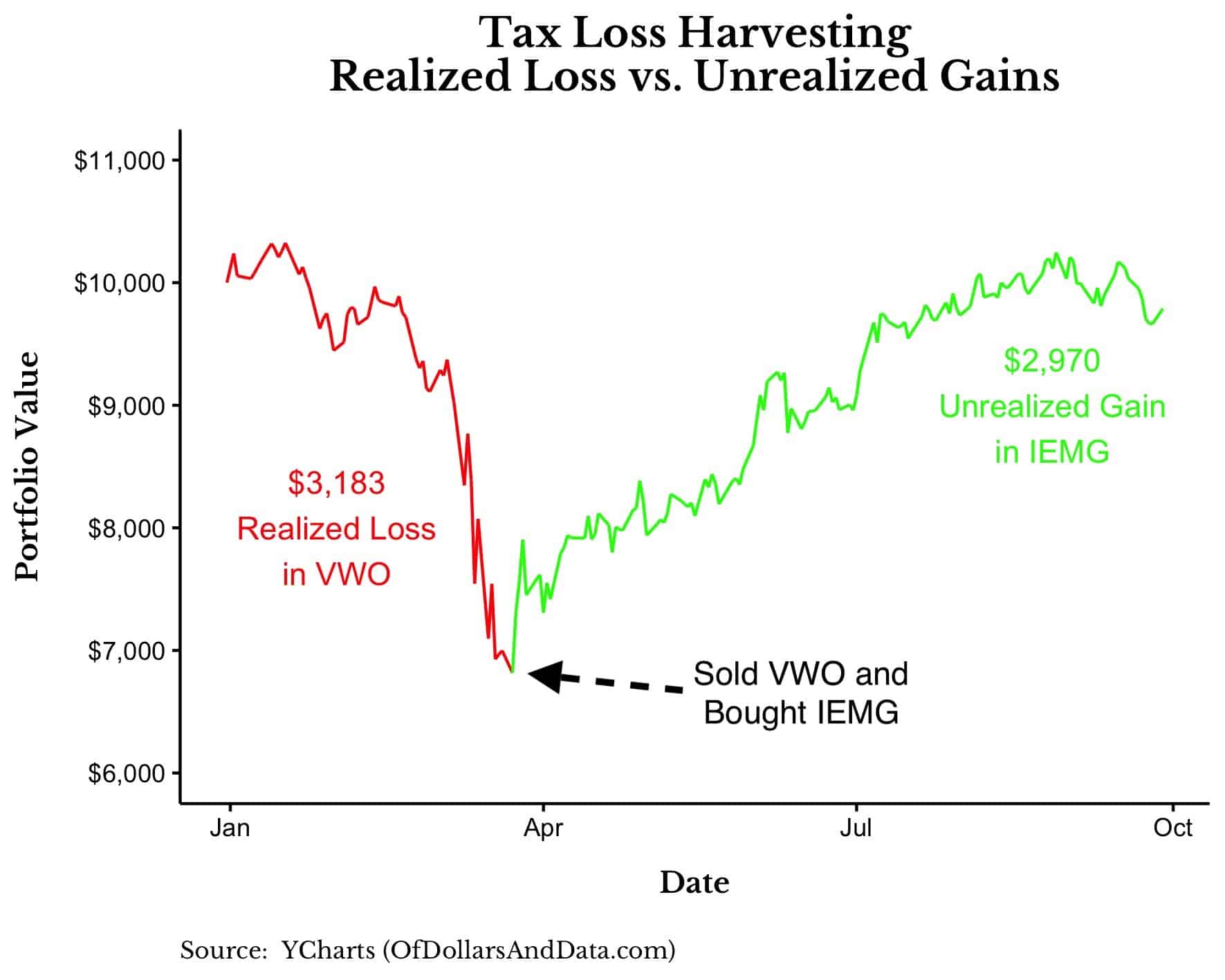

The 3 Ways Tax Loss Harvesting Can Save You Money Of Dollars And Data

Crypto Tax Loss Harvesting Investor S Guide Koinly

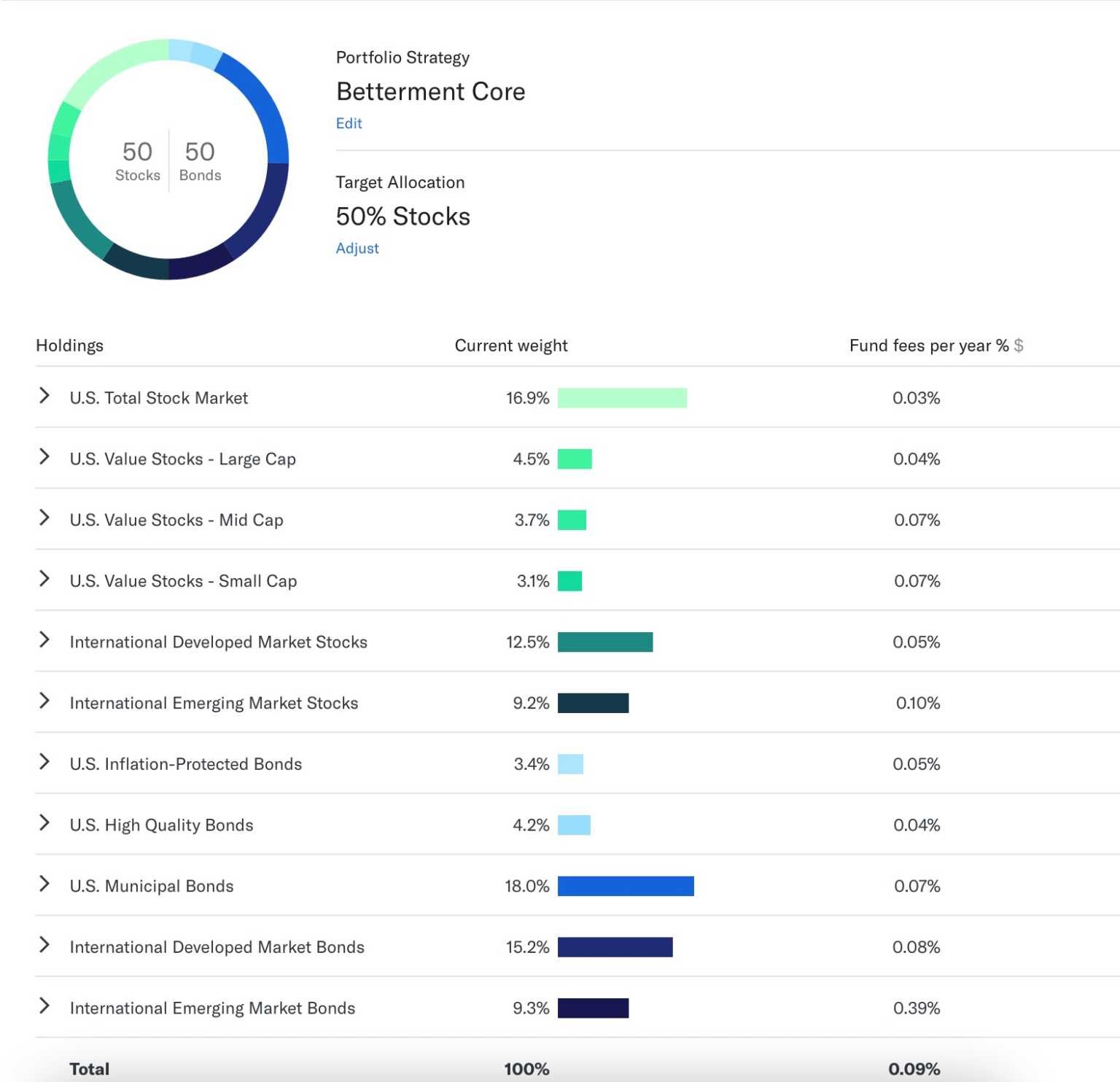

Tax Loss Harvesting Methodology

How Tax Loss Harvesting Can Reduce Your Tax Bill Personal Capital

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

What Is Tax Loss Harvesting Mission Wealth

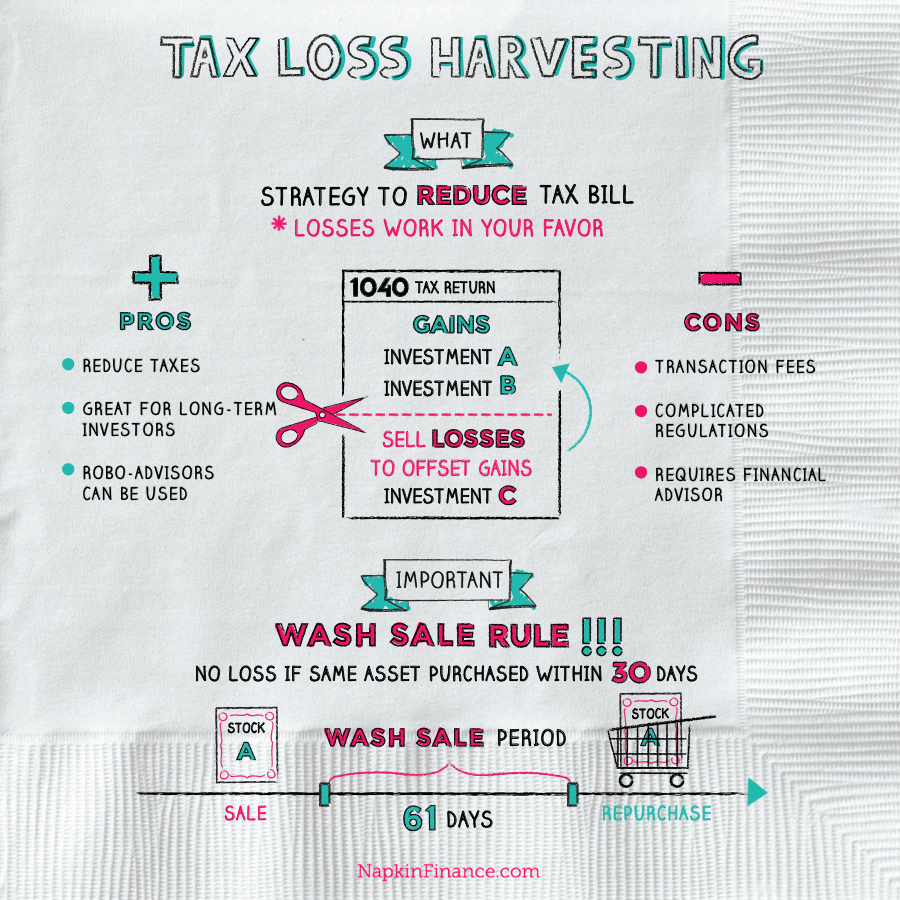

Tax Loss Harvesting Napkin Finance

Financial Planning Using Your Tax Return Morgan Stanley

Taxlossharvesting Napkin Finance

Tax Loss Harvesting Upside To A Down Market Brown Advisory

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting 2022 John Hancock Investment Mgmt

Tax Loss Harvesting Definition Rules Examples Seeking Alpha

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

Tax Loss Harvesting Napkin Finance

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire